Starting your Super Savings Early

When should you start saving for retirement?

Retirement seems a long way off when you’re in your 30s and 40s, but the reality is that planning ahead and boosting your super can make a substantial difference to the quality of your retirement. Compound earnings – the ability to earn interest on your interest – can significantly boost your eventual retirement nest egg.

Case Study

Rebecca and Andrew

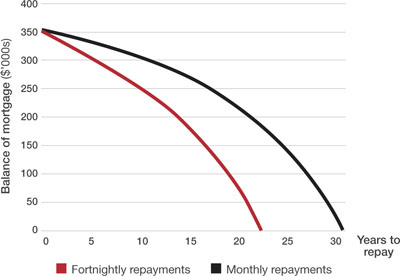

Take Rebecca and Andrew – two investors with similar ages and backgrounds but very different initial attitudes towards saving and investing.

Rebecca starts investing $2,000 a year for 10 years, or a total of $20,000, then leaves her money invested for the next 10 years without adding any more money. Eight years after Rebecca starts investing, Andrew begins investing $2,000 a year, over the next 12 years, for a total of $24,000.

By starting early, Rebecca will accumulate over $58,000 due to compounding interest. Despite the fact that Andrew will end up investing $4,000 more than Rebecca, he will receive less than half as much as Rebecca in earnings.

- 9.5%of your salary is contributed into your super fund by your employer

- $3.0Trillion dollars in Australian super assets as of December 2019

Major Life Events

Major life events can impact on your financial situation

Juggling your life and successfully managing your finances can be challenging. Most of us would rather spend time with our families than worry about how to best manage our money.

There are so many major life events during your 30s and 40s – getting married, buying your first home, having children and changing careers – all of which have a great impact on your financial situation.

Building your wealth is about putting long-term strategies in place. This could mean taking control of your budgeting and cash flow, managing your mortgage, putting in place investment strategies or all of these things.

It’s about looking at all aspects of your life and developing strategies that fit.

How We Can Help

- Budgeting and goal setting

- Savings and wealth creation strategies

- Insurance

- Superannuation planning

- Investment planning

- $297,100cost of a middle-income family to raise a child born in 2019 through the age of 17

- $65,400average cost of an Australian wedding

Paying Off Your Mortgage Sooner

How can you pay off your home loan sooner?

Taking out a mortgage is a big commitment. It is a large debt that requires strict budgeting to pay off as soon as possible.

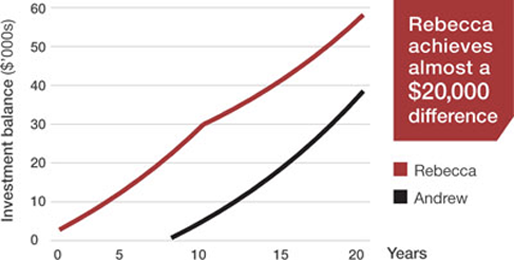

A simple strategy that can save years on the term of your mortgage is to halve your monthly repayments and pay them in fortnightly instalments.

Case Study

Jarrod’s Story

Jarrod was making monthly repayments of $2,500 off his $350,000 mortgage with an interest rate of 7.57 per cent per annum. At this rate, it would have taken him around 31 years to pay off his mortgage, and he would have made total repayments of over $955,000.

If he simply halved his usual monthly payment, and paid off his loan fortnightly, he would save eight years and over $186,000.

- 32.8%of households are under mortgage stress

- $486,225average NSW home loan amount